- The cannabis sector experienced significant growth in 2019 but then went on to decline eventually.

- However, the sector is now experiencing a robust resurgence this year, driven by rumors that the DEA may reclassify cannabis from Schedule 1 to Schedule 3.

- In this analysis, we will look at how you can invest in the sector, both through stocks and with specialized ETFs, and maximize your gains amid this strong rebound.

- If you invest in the stock market, get a 10% discount HERE, using the promo code INVESTINGPRO1. Find more information at the end of this article.

Cannabis stocks have been on a rollercoaster ride, going from a big boom in late 2019 to a crash in the following years.

A pivotal moment for the sector came in October 2018 when Canada fully legalized cannabis, sparking a rally in stocks and ETFs.

This was followed by another event in 2019 when the US regulations changed, leading to the decriminalization of recreational use in nearly half of the states in the country.

This led to several companies going public, as the first investment funds and specialized ETFs were introduced.

The frenzy was palpable, with many stocks tripling, while funds experienced remarkable gains of 100-150%. Eventually, the sector experienced a downturn as stocks and ETFs went out of favor with investors.

New Catalyst Could Garner Investor Interest

As of Monday’s close, the cannabis sector is in the midst of a strong rebound.

Behind this resurgence lies a significant rumor suggesting that the U.S. Drug Enforcement Agency (DEA) may reclassify cannabis from Schedule 1 to Schedule 3 substances.

Why is this crucial? Schedule 1 includes substances like heroin and LSD, whereas Schedule 3 encompasses substances approved by the FDA, and accessible by prescription.

Being in Schedule 1 restricts eligibility for credit or bank guarantees and prohibits interstate marketing. This development follows legalization efforts in the rest of the world.

In Europe, Malta took the lead by legalizing cannabis cultivation, possession, and consumption within certain limits.

Other European countries, including Croatia, Greece, Cyprus, Germany, Italy, Luxembourg, Norway, the Netherlands, and Finland, allow cannabis consumption for medicinal purposes.

Given this scenario, it’s essential to explore how to invest in cannabis, treating it as just another sector in the financial markets. Broadly, there are two avenues: investing in individual stocks or opting for ETFs.

1. Cannabis ETFs to Consider

- ETF AdvisorShares Pure US Cannabis

Managing more than $900 million, AdvisorShares Pure Cannabis (NYSE:) was created in 2020, with an annual fee of 0.83%.

It invests in companies generating at least 50% of their revenue from the marijuana business. It has surged 17.5% in 2024 so far.

- ETF MG US Alternative Harvest

Created in 2015, with an annual commission of 0.75%, this ETFMG Alternative Harvest (NYSE:) manages over $150 million. It invests in shares of the Prime Alternative Harvest index.

The ETF has gained 6% YTD.

2. Individual Stocks

It is a Canadian company founded 2013 and was one of the first to receive a license to grow marijuana from the Canadian Ministry of Health. In 2018 it began trading on the at $17.

It presents its results on April 9. The market gives it potential at $3.52.

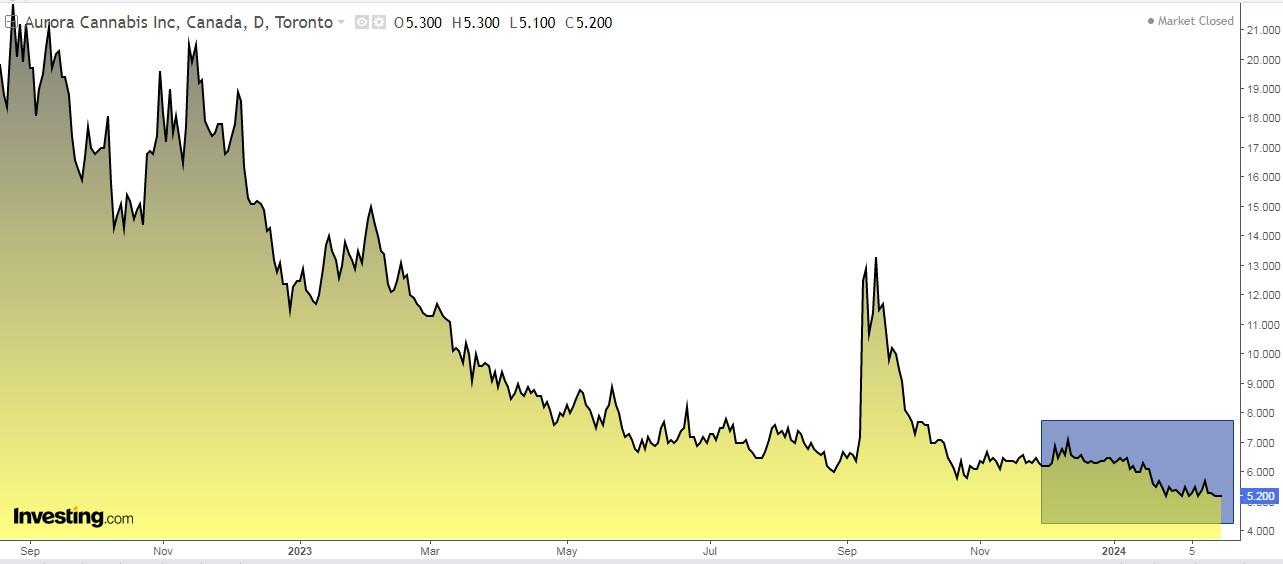

- Aurora Cannabis (NASDAQ:)

It is a Canadian marijuana producer operating in 25 countries. It debuted on the stock market in April 2017 and in October 2018 it went public on the New York Stock Exchange.

A key moment was when it acquired in 2018 CanniMed Therapeutics (TSX:).

On May 29, it presents its accounts. The market gives it potential at $9.

It is a company based in Ontario, Canada. It was the first marijuana producer in North America to be regulated and publicly traded.

In 2018 it made the jump to the New York Stock Exchange and became the company in the sector with the largest market capitalization.

On June 21 we will have its income statements. The market potential would be at $5.15.

It is a Canadian cannabis producer and distributor. It began trading on the Nasdaq in March 2018, and in May 2018 it began trading on the Toronto Stock Exchange.

We will have a date with its quarterly numbers on February 29. Market potential would put it at $2.45-2.50.

***

Do you invest in the stock market? Set up your most profitable portfolio HERE with InvestingPro!

Apply discount code INVESTINGPRO1 and you’ll get an instant 10% discount when you subscribe to the Pro or Pro+ annual or two-year plan. Along with it, you will get:

- ProPicks: AI-managed portfolios of stocks with proven performance.

- ProTips: Digestible information to simplify a lot of complex financial data into a few words.

- Advanced Stock Finder: Search for the best stocks based on your expectations, taking into account hundreds of financial metrics.

- Historical financial data for thousands of stocks: So that fundamental analysis professionals can delve into all the details themselves.

- And many other services we plan to add soon.

Subscribe Today!

Act fast and join the investment revolution – get your offer HERE!

Disclaimer: The author does not own any of these shares. This content, which is prepared for purely educational purposes, cannot be considered as investment advice.