The past couple of weeks have been positive for weed stocks after Tilray reported upbeat quarterly results as part of what was the first report upon completing its merger with Aphria while Congress has continued to make progress on discussions related to a widely-followed bill that could lead to the federal-level legalization of marijuana in the United States.

Momentum for weed stocks could continue to improve moving forward as we come closer to the discussion of such law and investors should position themselves for an upcoming jump in valuations if the House of Representatives nods at the bill in the following months.

To help you in short-listing the most promising stocks in this up-and-coming sector, the following article lists five names that could be poised to take in most of the upside if such a positive scenario unfolds.

#1 – GrowGeneration Corp (GRWG)

GrowGeneration sells equipment, tools, and virtually everything that both domestic and commercial growers need to plant and grow marijuana and other similar crops.

The company has an impressive track record of revenue growth, with sales moving from $29 million in 2018 to $193 million by the end of 2020. Meanwhile, gross margins have been improving during that same period, moving from 22% to 26% while the company has already swung to profitability, generating $5.3 million in net profits in 2020 for a 2.8% net margin.

Moving forward, analysts are expecting to see earnings per share exploding this year to $0.52 per share while estimates are a bit more pessimistic for the following two years (2022 and 2023) as growth is expected to decelerate.

Currently, the stock is trading at 81 times its 2021 EPS – a plausible multiple for a company that is growing at the pace of GrowGeneration. Moreover, the company has nearly no long-term debt.

Impressive growth rates, positive bottom-line profitability, growing margins, a robust balance sheet, and a decent valuation make this company a top growth pick in this sector.

67% of all retail investor accounts lose money when trading CFDs with this provider.

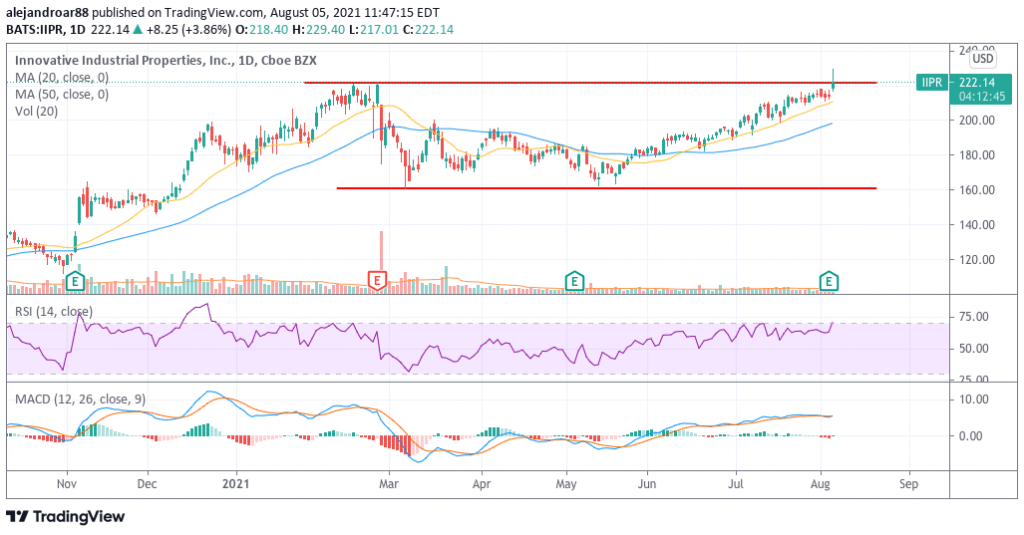

#2 – Innovative Industrial Properties (IIPR)

IIPR specializes in acquiring and leasing facilities that can be used for planting and growing cannabis and other similar crops. The company currently owns more than 50 facilities that are leased to top operators and the trust is structured to distribute at least 90% of its taxable income in the form of dividends.

From 2018 to 2020, revenues have jumped from $14.8 million to $116.9 million as more players have entered the industry while the company produced $117 million in adjusted funds from operations (AFFO) by the end of its 2021 fiscal year resulting in $5 in AFFO per share.

At its current price of $220 per share, IIPR is offering a 2.6% dividend yield while the price of the stock has gained 22% so far this year on top of the 151% gain it delivered last year.

Even though the dividend is not the most attractive, most of the upside for IIPR is coming, and should continue to come, from the progressive increase in the market value of its properties as demand for equipped facilities to grow marijuana should continue to pick up in the future as the industry keeps growing.

67% of all retail investor accounts lose money when trading CFDs with this provider.

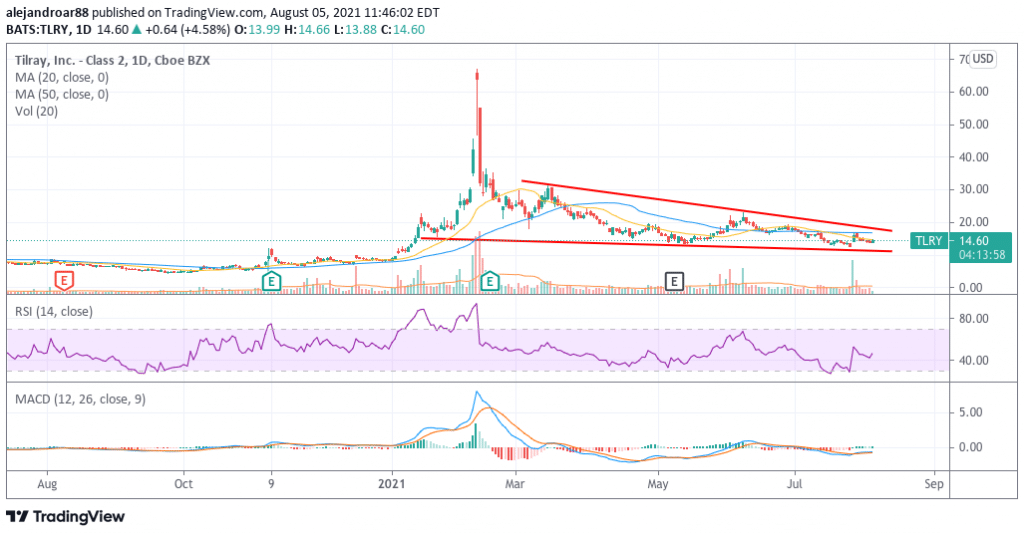

#3 – Tilray (TLRY)

The price of Tilray shares surged more than 25% on the day that the company released its first quarterly report after the merger with Aphria was complete. The firm unexpectedly swung to profits amid an adjustment in some debt-related fair value assessments.

Moving forward, the company is expected to emerge as one of the strongest players in this up-and-coming industry, with sales forecasted to jump by 16% during 2022 and 30% the year after that at around $1.3 billion.

At its current market capitalization of $7.3 billion, the firm is trading at only 6 times its 2023 sales which is a fairly conservative valuation metric for a company that may just be scratching the surface of its total addressable market.

Moreover, the firm’s finances are quite strong as Tilray is holding only $888 million in long-term debt on assets of $6 billion including $500 million in cash.

67% of all retail investor accounts lose money when trading CFDs with this provider.

#4 – Green Thumb Industries (CNSX: GTII)

Green Thumb operates over 55 stores in the United States selling cannabis products including edibles, concentrates, and other similar presentations through a wide range of brands.

The company was founded in 2014 and has managed to grow its sales at a fast pace in the past three years, with top-line results moving from $62.5 million back in 2018 to $556.7 million by the end of 2020.

Gross margins have also improved during this period from 45% to 55% while the company reported its first profitable year in 2020 as it delivered $15 million in profits for investors. Meanwhile, it reported a profitable first quarter of 2021 with net earnings landing at $10.4 million.

Moving forward, analysts are expecting to see earnings per share jumping to $0.37 by the end of 2021 and they are expected to nearly double in the two subsequent years. Moreover, the valuation is particularly attractive as Green Thumb is trading at 83 its forecasted earnings for this year.

The company has already proven its ability to grow its sales at a fast pace in a profitable way while the balance sheet is fairly robust as Green Thumb holds only $250 million in long-term debt on assets of $1.55 billion including $381 million in cash and equivalents.

Meanwhile, the firm swung to positive free cash flow last year, producing nearly $35 million in FCFs while it generated almost $20 million in FCFs during the first quarter of this year.

67% of all retail investor accounts lose money when trading CFDs with this provider.

#5 – ETFMG Alternative Harvest ETF (MJ)

For those who prefer to take a more conservative approach to incorporate cannabis stocks into their portfolios, the ETFMG Alternative Harvest ETF (MJ) offers diversified exposure to this industry as the fund currently holds 33 different stocks that participate in this up-and-coming sector.

The top ten holdings of the MJ ETF account for almost 60% of its total assets and two of the names mentioned in this list are included – GrowGeneration and Tilray. Moreover, other companies in which the fund invests include Canopy Growth (WEED) and the Cronos Group (CRON).

At the moment, the fund charges an annual expense ratio of 0.75% while it is managing $1.36 billion for investors.

67% of all retail investor accounts lose money when trading CFDs with this provider.